November 25, 2012

產權保險費只需支付一次,產權保險公司便會保障因為產權的毛病或其它保單發出前影響物業的事端而造成的未來損失。產權保險可以保障業主,貸款金融機構,或雙方的損失。

產權保險得到大多數加拿大主要銀行和金融機構接受。在住宅房地產交易中,產權保險不是必要的。但一些銀行或金融機構可能以產權保險作為conditions for funding(貸款條件)之一。在某些情況下,產權保險可用來代替Surveyor’s Real Property Report (測量師房地產報告)或Estoppel Certificate(禁止反言證書)。如果買家有用Power of Attorney(授權委託書)買住宅物業、或購買的物業價值超過銀行和金融機構指定的一定金額,買家亦會被要求購買產權保險。

請隨時與我聯絡,我會說流利的英語、普通話和粵語,為您提供進一步專業法律服務。

*** 注:本博客中所有內容僅供參考。請找律師提供專業及全面的法律意見。

Comments Off on Title Insurance (產權保險) |

Comments Off on Title Insurance (產權保險) |  Calgary Residential Real Estate, Real Estate Lawyer, 地產律師, 房地產律師 | Tagged: Aileen N L Kwan, Alberta, Calgary, conditions for funding, 產權保險, 禁止反言證書, 粵語, Edmonton, Estoppel Certificate, 英語, 關艾齡, 貸款條件, Law, Power of Attorney, Real Estate, residential properties, Surveyor’s Real Property Report, Title Insurance, 卡爾加里律師, 卡加利, 卡加利律師, 卡加利房地產, 卡城, 卡城律師, 卡城房地產, 卡尔加里, 卡尔加里律师, 卡尔加里房地产, 埃德蒙顿, 大律師, 律师, 愛城, 愛民頓, 房地產, 房地产, 授權委託書, 普通話, 測量師房地產報告, 亞省, 住宅物業 |

Calgary Residential Real Estate, Real Estate Lawyer, 地產律師, 房地產律師 | Tagged: Aileen N L Kwan, Alberta, Calgary, conditions for funding, 產權保險, 禁止反言證書, 粵語, Edmonton, Estoppel Certificate, 英語, 關艾齡, 貸款條件, Law, Power of Attorney, Real Estate, residential properties, Surveyor’s Real Property Report, Title Insurance, 卡爾加里律師, 卡加利, 卡加利律師, 卡加利房地產, 卡城, 卡城律師, 卡城房地產, 卡尔加里, 卡尔加里律师, 卡尔加里房地产, 埃德蒙顿, 大律師, 律师, 愛城, 愛民頓, 房地產, 房地产, 授權委託書, 普通話, 測量師房地產報告, 亞省, 住宅物業 |  Permalink

Permalink

Posted by aileenkwan

Posted by aileenkwan

November 25, 2012

For a one-time title insurance premium, title insurance company will insure future losses due to defects of title or other events affecting the property that happened before the policy was issued. Title insurance can insure against loss to either the owner of the property, the mortgage lender, or both.

Title insurance is acceptable by most major banks and financial institutions in Canada. Title insurance is not mandatory in all residential real estate transactions. However, some banks or financial institutions may require title insurance as one of the conditions for funding. In some cases, title insurance can be used in lieu of Real Property Report or Estoppel Certificate. Some major banks also require title insurance in cases where a Power of Attorney is used for the purchase of residential properties or if the value of the purchase price is over a certain amount as specified by the banks and financial institutions.

Please contact me for further legal advice.

*******

Note: All postings in this blog are for information only, please consult a lawyer for proper legal advice.

Comments Off on Title Insurance |

Comments Off on Title Insurance |  Calgary Residential Real Estate, Real Estate Lawyer, 地產律師, 房地產律師 | Tagged: Aileen N L Kwan, Alberta, Calgary, conditions for funding, 產權保險, 禁止反言證書, 粵語, Edmonton, Estoppel Certificate, 英語, 關艾齡, 貸款條件, Law, Power of Attorney, Real Estate, residential properties, Surveyor’s Real Property Report, Title Insurance, 卡爾加里律師, 卡加利, 卡加利律師, 卡加利房地產, 卡城, 卡城律師, 卡城房地產, 卡尔加里, 卡尔加里律师, 卡尔加里房地产, 埃德蒙顿, 大律師, 律师, 愛城, 愛民頓, 房地產, 房地产, 授權委託書, 普通話, 測量師房地產報告, 亞省, 住宅物業 |

Calgary Residential Real Estate, Real Estate Lawyer, 地產律師, 房地產律師 | Tagged: Aileen N L Kwan, Alberta, Calgary, conditions for funding, 產權保險, 禁止反言證書, 粵語, Edmonton, Estoppel Certificate, 英語, 關艾齡, 貸款條件, Law, Power of Attorney, Real Estate, residential properties, Surveyor’s Real Property Report, Title Insurance, 卡爾加里律師, 卡加利, 卡加利律師, 卡加利房地產, 卡城, 卡城律師, 卡城房地產, 卡尔加里, 卡尔加里律师, 卡尔加里房地产, 埃德蒙顿, 大律師, 律师, 愛城, 愛民頓, 房地產, 房地产, 授權委託書, 普通話, 測量師房地產報告, 亞省, 住宅物業 |  Permalink

Permalink

Posted by aileenkwan

Posted by aileenkwan

November 17, 2012

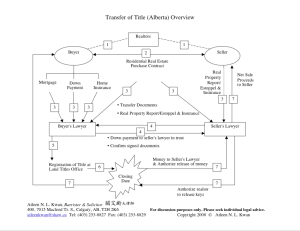

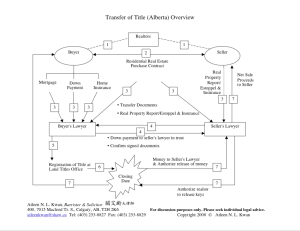

Transfer of Title Overview (click to zoom in)

以下是亞省住宅房地產買賣Title Transfer(過戶手續)的簡介。請放大打印一份上面的圖,對照以下的步驟及說明:

- 買賣雙方通常有自己的realtors(房地產中介/經紀)代表他們。

- 中介/經紀會為買賣雙方準備住宅房地產合同。

- 合同簽訂及conditions waived(條件滿足)之後,合同將交給買賣雙方的房地產律師處理。(a)買方要提供按揭文件,down payment(首付/首期),home insurance binder letter(房屋保險証明)(如果買獨立房屋)等資料給買方律師。(b)賣方要提供有Municipal Stamp of Compliance(市政府合規性契印)的Surveyor’s Real Property Report (測量師房地產報告)和/或Condominium management company information (公寓/城市屋管理公司的資料)給賣方律師去安排Estoppel Certificate(禁止反言證書)及Certificate of Insurance(保險證書)。

- 買賣雙方在各自的律師事務所簽署所有必須的文件。買方將首付/首期交到買方律師的信託戶口。

- 買方的律師提交Transfer of Land(轉讓土地)及Mortgage documents(按揭文件)到Alberta Land Titles Office(亞省土地註冊處)登記。

- 根據買方所選擇貸款公司的要求,交易會用Title Insurance(產權保險)或Western Conveyancing Protocol(西部省份房地產買賣協議)完成。

- 在Closing date(交收日),買方律師要在中午12時前向賣方律師交錢。收到錢後,賣方律師將通知賣方中介/經紀交出鑰匙。然後,買方中介/經紀便有鑰匙可以與買家檢查物業。然後,賣方律師便會將net sale proceeds(售賣款項淨額)交給賣方。

請隨時與我聯絡,我會說流利的英語、普通話和粵語,為您提供進一步專業法律服務。

*** 注:本博客中所有內容僅供參考。請找律師提供專業及全面的法律意見。

Comments Off on Transfer of Title Overview (過戶手續簡介) |

Comments Off on Transfer of Title Overview (過戶手續簡介) |  Calgary Residential Real Estate, Real Estate Lawyer, 地產律師, 房地產律師 | Tagged: Aileen N L Kwan, Alberta, Alberta Land Titles Office, binder letter, Calgary, Certificate of Insurance, Closing date, conditions waived, Condominium management company information, 產權保險, 禁止反言證書, 簡介, 粵語, 經紀, down payment, Edmonton, Estoppel Certificate, 過戶手續, 英語, 關艾齡, 西部省份房地產買賣協議, 首期, 首付, 轉讓土地, home insurance, Law, Mortgage documents, Municipal Stamp of Compliance, net sale proceeds, overview, Real Estate, realtor, Surveyor’s Real Property Report, Title Insurance, Title Transfer, Transfer of Land, Western Conveyancing Protocol, 公寓管理公司的資料, 卡爾加里律師, 卡加利, 卡加利律師, 卡加利房地產, 卡城, 卡城律師, 卡城房地產, 卡尔加里, 卡尔加里律师, 卡尔加里房地产, 售賣款項淨額, 埃德蒙顿, 城市屋管理公司的資料, 大律師, 市政府合規性契印, 律师, 愛城, 愛民頓, 房地產, 房地产, 房屋保險証明, 按揭文件, 普通話, 條件滿足, 測量師房地產報告, 中介, 亞省, 亞省土地註冊處, 交收日, 保險證書 |

Calgary Residential Real Estate, Real Estate Lawyer, 地產律師, 房地產律師 | Tagged: Aileen N L Kwan, Alberta, Alberta Land Titles Office, binder letter, Calgary, Certificate of Insurance, Closing date, conditions waived, Condominium management company information, 產權保險, 禁止反言證書, 簡介, 粵語, 經紀, down payment, Edmonton, Estoppel Certificate, 過戶手續, 英語, 關艾齡, 西部省份房地產買賣協議, 首期, 首付, 轉讓土地, home insurance, Law, Mortgage documents, Municipal Stamp of Compliance, net sale proceeds, overview, Real Estate, realtor, Surveyor’s Real Property Report, Title Insurance, Title Transfer, Transfer of Land, Western Conveyancing Protocol, 公寓管理公司的資料, 卡爾加里律師, 卡加利, 卡加利律師, 卡加利房地產, 卡城, 卡城律師, 卡城房地產, 卡尔加里, 卡尔加里律师, 卡尔加里房地产, 售賣款項淨額, 埃德蒙顿, 城市屋管理公司的資料, 大律師, 市政府合規性契印, 律师, 愛城, 愛民頓, 房地產, 房地产, 房屋保險証明, 按揭文件, 普通話, 條件滿足, 測量師房地產報告, 中介, 亞省, 亞省土地註冊處, 交收日, 保險證書 |  Permalink

Permalink

Posted by aileenkwan

Posted by aileenkwan

October 4, 2008

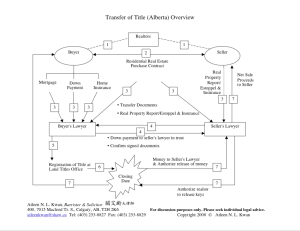

Transfer of Title Overview (click to zoom in)

In this blog entry I will give you an overview of the process of Title Transfer in a Residential Real Estate Purchase and Sale Transaction in Alberta.

The steps in the following list corresponds to the above diagram. Feel free to print a large copy of the diagram to go along with the following explanations.

- Buyer and seller will usually have their own realtors representing them.

- A Residential Real Estate Purchase Contract will be prepared by the relators for the buyer and the seller.

- Once the contract is signed and all the conditions are waived, the real estate purchase contract will be given to the buyer’s and seller’s respective real estate lawyers. (a) Buyer will have to provide mortgage, down payment, home insurance binder letter (if buying a single family home) information to his/her lawyer. (b) Seller will have to provide Surveyor’s Real Property Report (with Municipal Stamp of Compliance) and/or condominium management company information for his/her lawyer to order an Estoppel Certificate & Certificate of Insurance.

- Buyer and seller to attend at their respective lawyers office for the signing of all necessary documents. Buyer to provide down payment to his/her lawyer in trust.

- Buyer’s lawyer to submit Transfer of Land and Mortgage documents at the Alberta Land Titles Office for registration.

- Depending on the mortgage company that the buyer has selected, the transaction can be closed by way of Title Insurance or Western Conveyancing Protocol.

- On Closing Date, buyer’s lawyer is to provide the money to the seller’s lawyer by 12 noon. Upon receipt of money, the seller’s lawyer will contact the seller’s realtor to authorize the release of keys. The buyer’s realtor will then have the keys to take the buyer for a walk through and inspection of the property. The seller’s lawyer can then release the net sale proceeds to the seller.

You may contact me for further legal advice.

*******

Note: All postings in this blog are for information only, please consult a lawyer for proper legal advice.

Comments Off on Transfer of Title Overview |

Comments Off on Transfer of Title Overview |  Calgary Residential Real Estate, Real Estate Lawyer, 地產律師, 房地產律師 | Tagged: Aileen N L Kwan, Alberta, Alberta Land Titles Office, binder letter, Calgary, Certificate of Insurance, Closing date, conditions waived, Condominium management company information, 產權保險, 禁止反言證書, 簡介, 粵語, 經紀, down payment, Edmonton, Estoppel Certificate, 過戶手續, 英語, 關艾齡, 西部省份房地產買賣協議, 首期, 首付, 轉讓土地, home insurance, Law, Mortgage documents, Municipal Stamp of Compliance, net sale proceeds, overview, Real Estate, realtor, Surveyor’s Real Property Report, Title Insurance, Title Transfer, Transfer of Land, Western Conveyancing Protocol, 公寓管理公司的資料, 卡爾加里律師, 卡加利, 卡加利律師, 卡加利房地產, 卡城, 卡城律師, 卡城房地產, 卡尔加里, 卡尔加里律师, 卡尔加里房地产, 售賣款項淨額, 埃德蒙顿, 城市屋管理公司的資料, 大律師, 市政府合規性契印, 律师, 愛城, 愛民頓, 房地產, 房地产, 房屋保險証明, 按揭文件, 普通話, 條件滿足, 測量師房地產報告, 中介, 亞省, 亞省土地註冊處, 交收日, 保險證書 |

Calgary Residential Real Estate, Real Estate Lawyer, 地產律師, 房地產律師 | Tagged: Aileen N L Kwan, Alberta, Alberta Land Titles Office, binder letter, Calgary, Certificate of Insurance, Closing date, conditions waived, Condominium management company information, 產權保險, 禁止反言證書, 簡介, 粵語, 經紀, down payment, Edmonton, Estoppel Certificate, 過戶手續, 英語, 關艾齡, 西部省份房地產買賣協議, 首期, 首付, 轉讓土地, home insurance, Law, Mortgage documents, Municipal Stamp of Compliance, net sale proceeds, overview, Real Estate, realtor, Surveyor’s Real Property Report, Title Insurance, Title Transfer, Transfer of Land, Western Conveyancing Protocol, 公寓管理公司的資料, 卡爾加里律師, 卡加利, 卡加利律師, 卡加利房地產, 卡城, 卡城律師, 卡城房地產, 卡尔加里, 卡尔加里律师, 卡尔加里房地产, 售賣款項淨額, 埃德蒙顿, 城市屋管理公司的資料, 大律師, 市政府合規性契印, 律师, 愛城, 愛民頓, 房地產, 房地产, 房屋保險証明, 按揭文件, 普通話, 條件滿足, 測量師房地產報告, 中介, 亞省, 亞省土地註冊處, 交收日, 保險證書 |  Permalink

Permalink

Posted by aileenkwan

Posted by aileenkwan

Posted by aileenkwan

Posted by aileenkwan